Tough financial decisions can affect both current and future tax bills, and lining up a team of professional advisors who are ready and willing to help makes a difference. For the most benefit, make sure your advisors know each other and work well together. As you begin your year-end planning, here are three areas where coordinating tax, legal, and financial advice can pay off.

Investments. Capital gains and losses from sales of your securities affect your taxes, of course, but the kind of investments you make can also have an impact. For instance, buying municipal bonds to generate tax-free interest may result in the unintended outcome of creating income subject to the alternative minimum tax.

Insurance. The type of health insurance plan you select can have tax implications. An example: A Health Savings Account (HSA), used in conjunction with a high-deductible health plan, can save premium and tax dollars. You fund an HSA with pre-tax cash and take tax-free withdrawals to pay medical expenses.

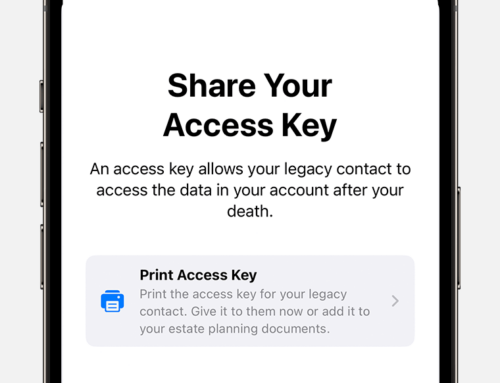

Estate planning. Wills, trusts, and beneficiary designations provide the framework for carrying out your wishes after your death. Communication between your tax and legal advisors helps ensure that these documents offer the greatest protection for your heirs while minimizing estate tax consequences.

We work with clients’ professional advisors in a team approach to serve our clients. If you need a professional advisor to join your team, you may find professionals we recommend at Partners and Clients.

Please call us to schedule a comprehensive review of your goals. We are delighted to be part of your professional team.

For more guidance see related articles:

Plan Now to Save on Taxes Later

Conquer Your Capital Gains Concerns!

Get the Maximum Tax Benefit from a Casualty Loss Deduction

Portability Can Simply Estate Planning. Will Portability Help You?

Review Your Beneficiary Choices and Consider the Tax Consequences

Leave A Comment